The Buzz on Top 30 Forex Brokers

The Buzz on Top 30 Forex Brokers

Blog Article

Things about Top 30 Forex Brokers

Table of ContentsOur Top 30 Forex Brokers StatementsTop 30 Forex Brokers for DummiesThe Of Top 30 Forex BrokersTop 30 Forex Brokers Things To Know Before You BuyUnknown Facts About Top 30 Forex BrokersTop 30 Forex Brokers - Questions7 Easy Facts About Top 30 Forex Brokers Shown

Foreign exchange is the largest and most liquid market in the world. A profession as a forex trader can be lucrative, versatile, and extremely appealing. There is a steep knowing curve and foreign exchange investors deal with high dangers, take advantage of, and volatility.

There are numerous advantages that a career as a foreign exchange trader, additionally called a foreign exchange trader, supplies. They consist of: Foreign exchange trading can have really reduced prices (brokerage firm and payments). There are no commissions in an actual sensemost forex brokers make benefit from the spreads in between foreign exchange currencies. One does not need to fret about including different brokerage fees, removing overhead expenses.

A Biased View of Top 30 Forex Brokers

The foreign exchange markets run throughout the day, making it possible for trades at one's comfort, which is really beneficial to temporary traders that have a tendency to take placements over short periods (say a few mins to a few hours). Couple of traders make professions during full off-hours. Australia's daytime is the nighttime for the East Coastline of the U.S.

business hoursService as little development is growth and anticipated are rates a stable range steady variety off-hours for AUD. Such investors embrace high-volume, low-profit trading methods, as they have little revenue margins because of a lack of advancements certain to forex markets. Instead, they try to make revenues on fairly secure low volatility duration and compensate with high quantity trades.

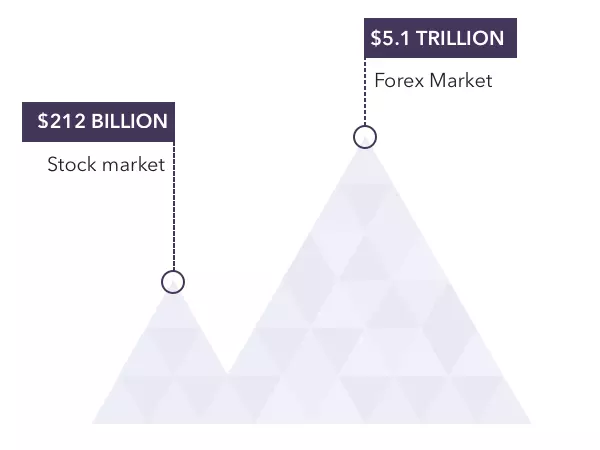

Foreign exchange trading is really suiting in this way. Contrasted with any various other economic market, the foreign exchange market has the largest notional value of everyday trading. This offers the highest level of liquidity, which indicates also large orders of currency trades are easily loaded effectively without any type of huge cost variances.

Unless major occasions are anticipated, one can observe comparable price patterns (of high, mid, or reduced volatility) throughout the non-stop trading.

The 25-Second Trick For Top 30 Forex Brokers

Such a decentralized and (relatively) decontrolled market aids avoid any unexpected shocks. Contrast that to equity markets, where a company can instantly declare a returns or record significant losses, bring about substantial cost modifications. This low degree of regulation also helps keep prices reduced. Orders are straight positioned with the broker that implements them on their own.

The significant money frequently show high cost swings. If professions are put carefully, high volatility helps in substantial profit-making opportunities. A forex investor who loves volatility can conveniently change from one currency set to another.

Excitement About Top 30 Forex Brokers

Without more funding, it may not be possible to trade in various other markets (like equity, futures, or alternatives). Availability of margin trading with a high take advantage of aspect (approximately 50-to-1) comes as the topping on the cake for foreign exchange professions. While trading on such high margins features its very own threats, it also makes it less complicated to improve earnings possibility with restricted funding.

Because of the huge size of the foreign exchange market, it is much less prone to expert trading than some other markets, particularly for significant currency sets. It is still often subject to market adjustment. Fundamentally, there are whole lots of benefits to forex trading as a job, yet there are negative aspects too.

An Unbiased View of Top 30 Forex Brokers

Being broker-driven ways that the forex market may not be totally transparent. An investor may not have any control over exactly how his trade order gets satisfied, might browse around here not obtain the most effective price, or might obtain minimal views on trading quotes as offered only by his picked broker. A straightforward option is to deal just with managed brokers who drop within the province of broker regulatory authorities.

Forex rates are affected by numerous factors, primarily worldwide national politics or economics that can be hard to analyze details and attract trusted conclusions to trade on., which is the main factor for the high volatility in foreign exchange markets.

The smart Trick of Top 30 Forex Brokers That Nobody is Discussing

Foreign exchange traders are entirely on their own with little or no assistance. Disciplined and continuous self-directed learning is a must throughout the trading career.

Report this page